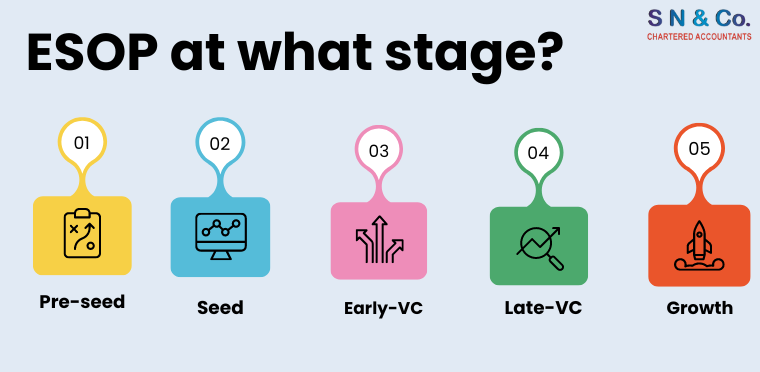

What is the Perfect Timing to issue ESOPs?

Let’s dive into the world of ESOPs and understand when and who should consider implementing them. Stage 1: preseed: At a pre-seed stage, founders primarily focused on gaining traction, an ESOP might not seem necessary. Key employees are often granted equity or options on an ad hoc basis. Stage 2: Seed: At the seed stage,…